VAT - Overview

This section will give you a brief overview about how you can configure VAT in Zoho Inventory.

Configure VAT in Zoho Inventory

You’ll have to configure your VAT settings by enabling VAT and setting up VAT rates in Zoho Inventory to get started. Here’s how:

Enable VAT Settings

Here’s how you can enable VAT settings for your organization:

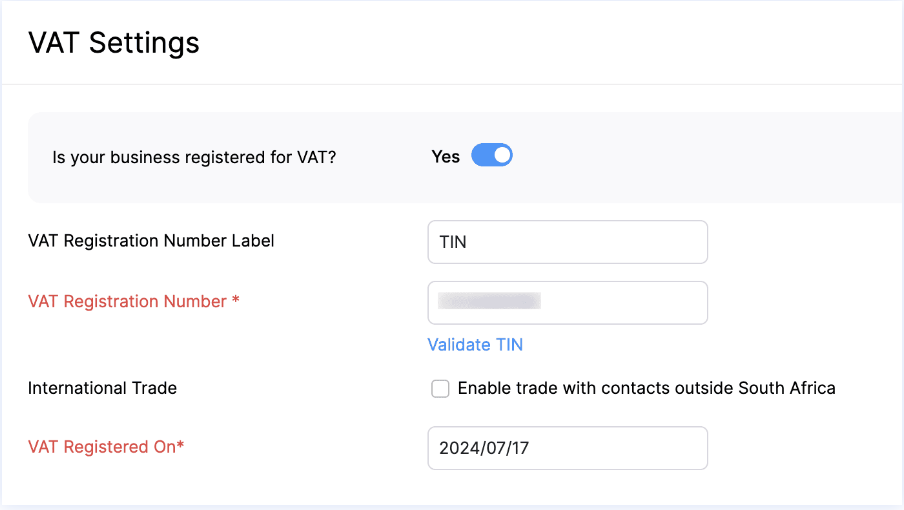

Go to Settings in the top right corner and click VAT.

Slide the toggle next to Is your business registered for VAT?

Enter the VAT Registration Number.

Mark Enable trade with contacts outside South Africa if your business involves international trade.

Enter the VAT Registered On date.

Click Save.

VAT Rates

Once VAT is enabled, the following tax rates will be added to your organization and will be automatically applied to future transactions:

| VAT Rate | Description |

|---|---|

| Standard Rate [15%] | Most of the goods and services that are included in transactions after April, 2018 fall under this tax rate. |

| Zero Rate [0%] | A tax rate of 0% is applied on goods that are agricultural supplies or residential lettings. Services that include road and rail transport, financial services, money lending, retirement and medical benefits, and international support are zero-rated. |

| Exempt | Exempt is provided in the following cases:

|

| Change in use (Non-taxable supplies) [15%] | Purchasing a good for business, intending for making taxable supplies and later using it for personal use. |

| Change in use (Taxable supplies) [15%] | Purchasing a good for personal use and later using it for taxable supplies. |

| Export of second-hand goods | Purchasing a second-hand good and exporting it later. |

| Supply of accommodation exceeding 28 days [15%] | When accommodation is provided for more than 28 days, the VAT will be calculated only for 60% of the total cost. |

| Supply of accommodation not exceeding 28 days [15%] | When accommodation is provided for 28 days or less than 28 days, the VAT will be calculated for the total cost. |

Create a VAT Rate

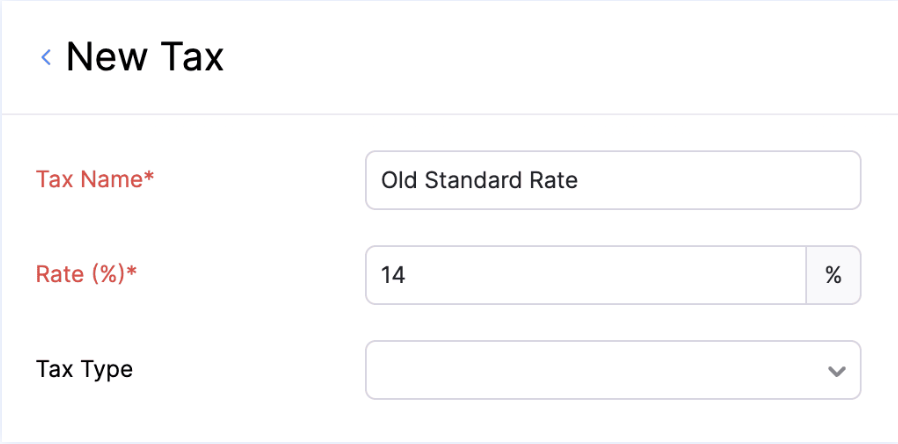

You can create a new VAT rate, for example, the Old Standard Rate [14%]. Here’s how:

Select VAT Rates under VAT.

Click + New VAT in the top right corner.

Enter the Tax Name and Rate.

Select a Tax Type from the dropdown.

Click Save.

The new VAT rate will be created and can be applied when you create a transaction.

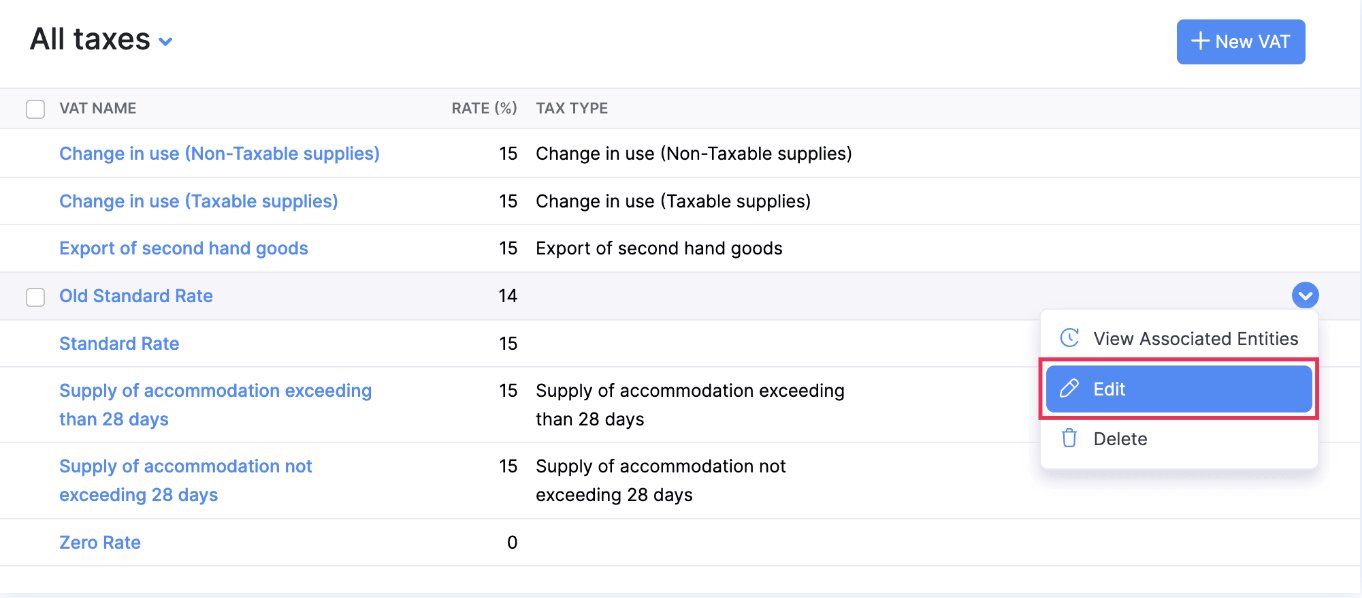

Edit a VAT Rate

Note: You can only edit the VAT rate that you have created. Changes cannot be made to the default VAT rates.

Here’s how you can edit a VAT rate:

Hover over the tax rate you’ve created and click the down arrow next to it.

Select Edit and make the required changes.

Click Save.

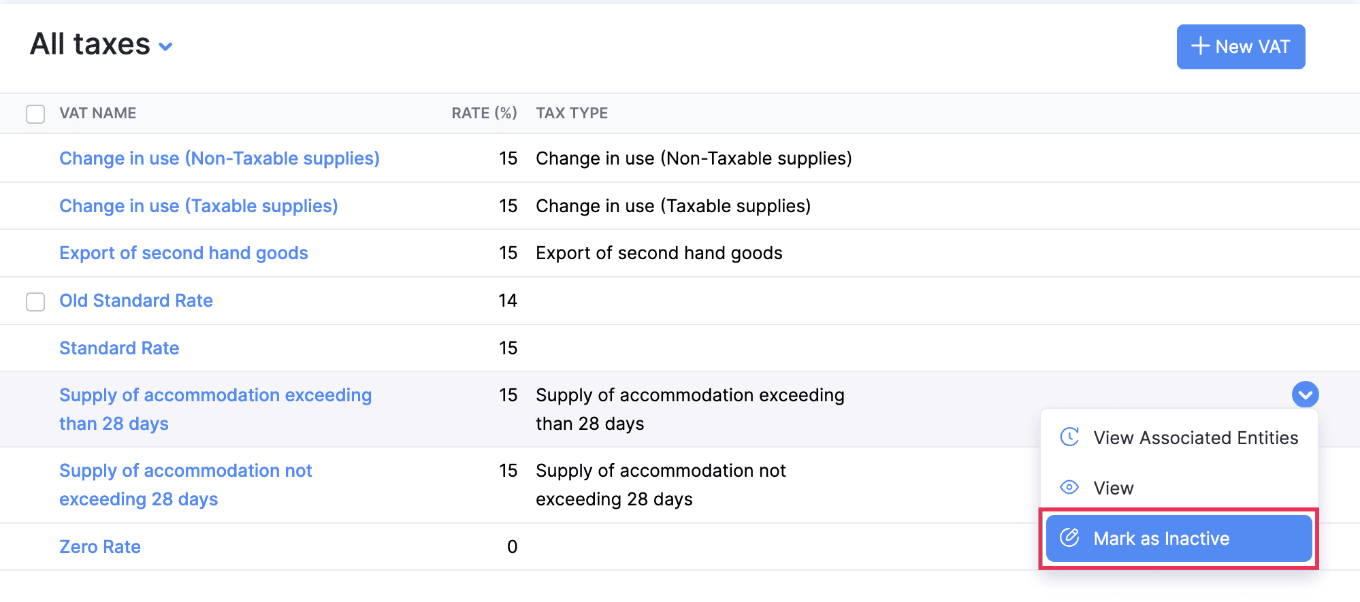

Mark a VAT Rate As Inactive

The default taxes that you don’t want to use can be marked as inactive. Here’s how:

Hover over a default tax rate and click the down arrow next to it.

Select Mark as Inactive.

The VAT rate will be marked as inactive.

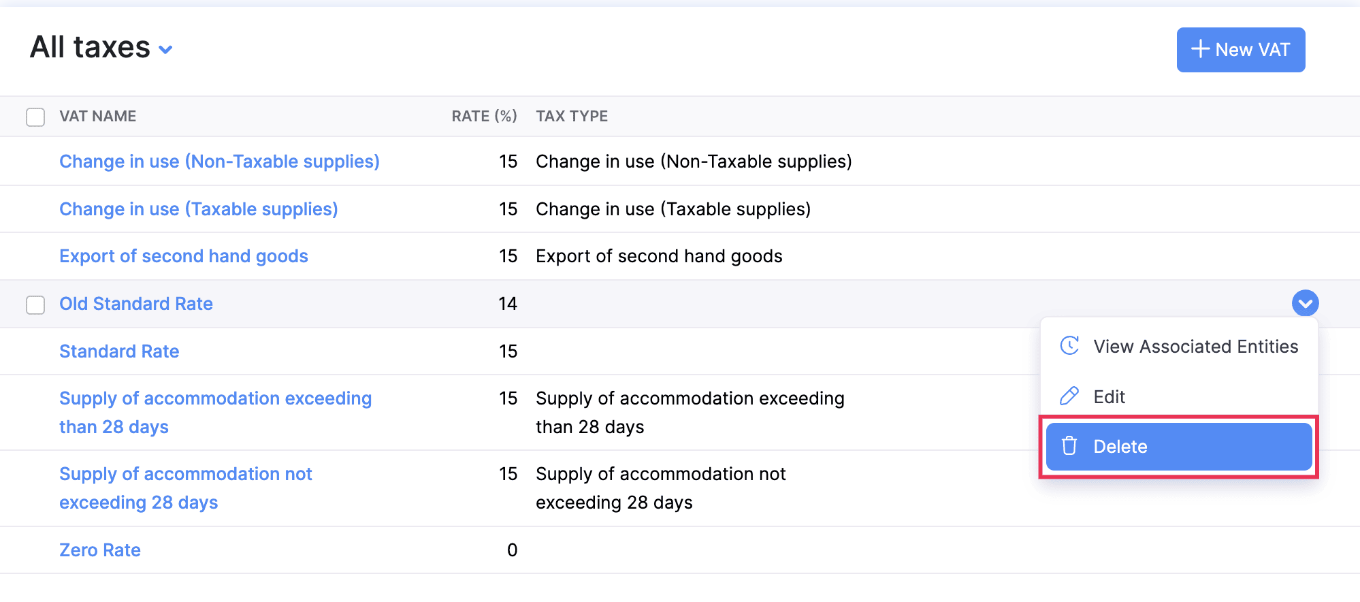

Delete a VAT Rate

Note: You cannot delete default VAT rates.

Here’s how you can delete a VAT rate:

Hover over the tax rate you’ve created and click the down arrow next to it.

Select Delete.

The VAT rate will be deleted.

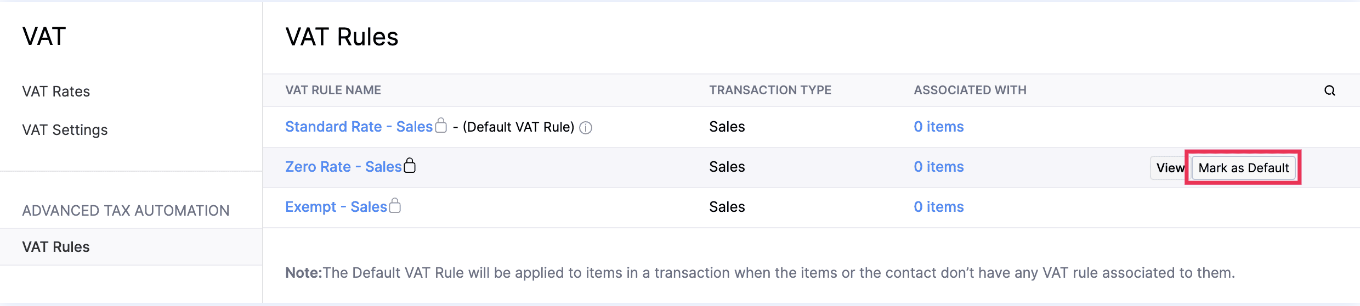

VAT Rules

Once you enable VAT for your organization, the following VAT rates will be created automatically:

- Standard Rate [15%]

- Zero Rate [0%]

- Exempt

You can mark any of these tax rates as default. Here’s how:

Select VAT Rates under Advanced Tax Automation.

Hover over the tax rate that you want to set as default.

Click Mark as Default.

Now, the tax rate will be set as the default tax rate and will be applied automatically when you create a transaction unless the item is associated with a different VAT rule.

VAT Treatment

In Zoho Inventory, you can create VAT-compliant transactions once VAT has been enabled. To do this, you can associate a VAT treatment to your customers based on which VAT will be applied to their transactions.

Here’s how you can associate a VAT Treatment:

- Go to Customers from the left sidebar.

- Click +New in the top right corner.

- Enter the necessary details.

- Select the applicable VAT treatment from the dropdown next to VAT Treatment.

- Click Save.

| VAT Treatment | Description | VAT Rate |

|---|---|---|

| VAT Registered | The customers whose business location is in South Africa and are registered with SARS to charge VAT on their sales. |

|

| Non VAT Registered | Non VAT registered customers are those whose business location is in South Africa but are not VAT registered. |

|

| Overseas | Overseas is a type of VAT treatment applicable for customers who are outside South Africa. |

|